Under a Confederate System of Government Where Is the Most Power Located

Learning Outcomes

By the end of this subdivision, you testament live able to:

- Explicate the concept of federalism

- Discuss the constitutional logic of federalism

- Identify the powers and responsibilities of federal, state, and local governments

Modern democracies split up governmental power in two general slipway; some, like the United States, use a combination of both structures. The first and Thomas More common mechanics shares power among trine branches of governance—the legislature, the executive, and the judiciary. The ordinal, federalism, apportions power between two levels of government: national and subnational. In the United States, the term federal government refers to the government at the national level, while the term states means governments at the subnational level.

view it

Observe this video to instruct more about the federal system of government and the powers of the national, state, and localised governments.

FEDERALISM DEFINED AND CONTRASTED

Federalism is an institutional arrangement that creates 2 relatively autonomous levels of government, each possessing the capacity to act directly on behalf of the people with the authority granted to it away the national constitution.[1] Although nowadays's federal systems vary in conception, five structural characteristics are popular to the U.S. and other regime systems around the world, including Germany and Mexico.

First, all federal systems establish two levels of government, with both levels being elected by the masses and each pull dow assigned different functions. The national government is responsible for handling matters that affect the country as a whole, for example, defending the nation against foreign threats and promoting national economic prosperity. Subnational, or state governments, are responsible for matters that lie within their regions, which include ensuring the asymptomatic-being of their people by administering educational activity, healthcare, public safe, and other open services. By definition, a system like this requires that distinguishable levels of political science cooperate, because the institutions at each level form an interacting network. In the U.S. federal system, all public matters are handled by the Federal regime, which is led by the president and members of Sexual congress, all of whom are elected by voters across the country. All matters at the subnational grade are the responsibility of the fifty states, each headed away an elected regulator and legislative assembly. Thus, there is a separation of functions betwixt the federal and state governments, and voters choose the leader at each level.[2]

The secondly characteristic common to all government systems is a written political entity organization that cannot Be changed without the satisfying consent of subnational governments. In the American federal system, the twenty-cardinal amendments added to the Constitution since its adoption were the result of an arduous mental process that required approval by two-thirds of both houses of Congress and three-fourths of the states. The intense reward of this supermajority requisite is that no changes to the Composition can occur unless in that location is broad support within Congress and among states. The potential drawback is that numerous national amendment initiatives—such as the Equal Rights Amendment (ERA), which aims to guarantee coequal rights regardless of sex—give failed because they cannot garner decent consent among members of Congress or, in the case of the Geological era, United States of America.

Third, the constitutions of countries with federal systems officially allocate legislative, judicial, and executive say-so to the two levels of political science in such a way equally to ensure all level some degree of autonomy from the other. Under the U.S. Constitution, the president assumes executive power, Congress exercises civil law powers, and the northern courts (e.g., U.S. district courts, appellant courts, and the Maximal Court) seize judicial powers. In each of the fifty states, a governor assumes enforcement authority, a state legislature makes laws, and state-level courts (e.g., trial courts, intermediate appellant courts, and supreme courts) possess judicial authority.

While to each one degree of government is somewhat independent of the others, much of fundamental interaction occurs among them. In fact, the ability of the federal and state governments to achieve their objectives frequently depends on the cooperation of the other even out of governing. For deterrent example, the Union soldier government's efforts to ascertain homeland security are bolstered by the affaire of law enforcement agents working at local and state levels. Then again, the ability of states to provide their residents with common education and health care is increased by the federal government's financial help.

Another common characteristic of federalism around the world is that national courts commonly resolve disputes between levels and departments of government. In the United States, conflicts between states and the federal government are adjudicated away federal courts, with the U.S. Supreme Romance existence the final arbiter. The resolution of such disputes pot maintain the autonomy of one level of government, as illustrated new when the State supreme court ruled that states cannot interfere with the federal politics's actions relating to immigration.[3] In other instances, a Supreme Tourist court ruling posterior wear away that autonomy, as demonstrated in the 1940s when, in United States v. Wrightwood Dairy farm Cobalt., the Court enabled the federal government to regulate commercial activities that occurred within states, a function previously handled solely by the states.[4]

Finally, subnational governments are always represented in the upper house of the national legislature, enabling regional interests to influence national lawmaking.[5] In the American federal organization, the US Senate functions A a territorial body by representing the fifty states: Each body politic elects two senators to ensure isochronous representation regardless of state population differences. Thusly, authorities laws are wrought in part by state interests, which senators convey to the federal policymaking process.

connectedness to scholarship

The governmental purpose of the US Government is unusual; nearly countries execute not have a federal social structure. Aside from the United States, how many new countries have a federal system?

Division of power can also occur via a unitary social system or confederation. In contrast to federalism, a unitary system makes subnational governments contingent on the national government, where significant government agency is concentrated. In front the Modern 1990s, the Incorporate Kingdom's state system of rules was centered to the extent that the national government held the most important levers of major power. Since and so, power has been step by step decentralized through a process of devolution, directing to the initiation of location governments in Scotland, Wales, and Northern Ireland as well as the delegation of specific responsibilities to them. Unusual democratic countries with one systems, such as France, Japan, and Sweden, experience followed a similar path of decentralisation.

Figure 1. In that respect are tercet general systems of government—unitary systems, federations, and confederations—from each one of which allocates mogul differently.

In a confederation, authority is decentralized, and the central government's ability to act depends on the consent of the subnational governments. Under the Articles of Confederation (the beginning Old Ironsides of the U.S.), states were sovereign and powerful while the national government was inferior and weak. Because states were reluctant to have prepared whatever of their power, the national government lacked authority in the face of challenges such as service the war debt, end commercial disputes among states, negotiating trade agreements with other countries, and addressing popular uprisings that were sweeping the state. As the brief American undergo with confederation clearly shows, the main drawback with this system of rules of government is that it maximizes regional self-rule at the expense of effective position brass.

FEDERALISM AND THE CONSTITUTION

The Constitution contains some provisions that direct the functioning of U.S. federalism. Some delineate the scope of national and state power, spell others restrict it. The remaining provisions shape relationships among the states and between the states and the federal authorities.

The enumerated powers of the national legislature are found in Article I, Section 8. These powers define the jurisdictional boundaries within which the federal government has authority. In seeking not to replay the problems that plagued the young country low-level the Articles of Confederation, the Constitution's framers granted U.S. Congress specific powers that ensured its authority all over national and foreign affairs. To provide for the general eudaimonia of the populace, information technology can tax, take up money, regulate interstate and foreign commerce, and protect property rights, for instance. To provide for the grassroots defense of the mass, the federal government can rear and digest armies and hold war. Furthermore, national integration and oneness are parented with the government's powers over the coining of money, naturalization, postal services, and other responsibilities.

The last article of Article I, Section 8, commonly referred to as the lively article surgery the necessary and proper induce, enables Congress "to make all Pentateuch which shall be necessary and victorian for carrying" out its constitutional responsibilities. Patc the enumerated powers define the policy areas in which the national government has sureness, the elastic clause allows it to make the legal means to fulfill those responsibilities. However, the nonunion-ended construction of this clause has enabled the nationalist government to expand its authority beyond what is specified in the Constitution, a development also motivated by the expansive interpretation of the mercantilism article, which empowers the federal government to regulate interstate economic transactions.

The powers of the state governments were never listed in the original Constitution. The consensus among the framers was that states would retain any powers non prohibited by the Organic law or delegated to the national government.[6] However, when it came time to ratify the Constitution, a number of states requested that an amendment be added explicitly identifying the reserved powers of U.S.A.. What these Anti-Federalists sought was further self-confidence that the subject government's capacitance to do directly on behalf of the people would be restricted, which the first ten amendments (Bill of Rights) provided. The 10th Amendment affirms the States' diffident powers: "The powers not delegated to the Unsegmented States by the Constitution, nor tabu by it to the States, are reserved to the States respectively, surgery to the people." So, state constitutions had bills of rights, which the first Congress used as the source for the first ten amendments to the Organic law.

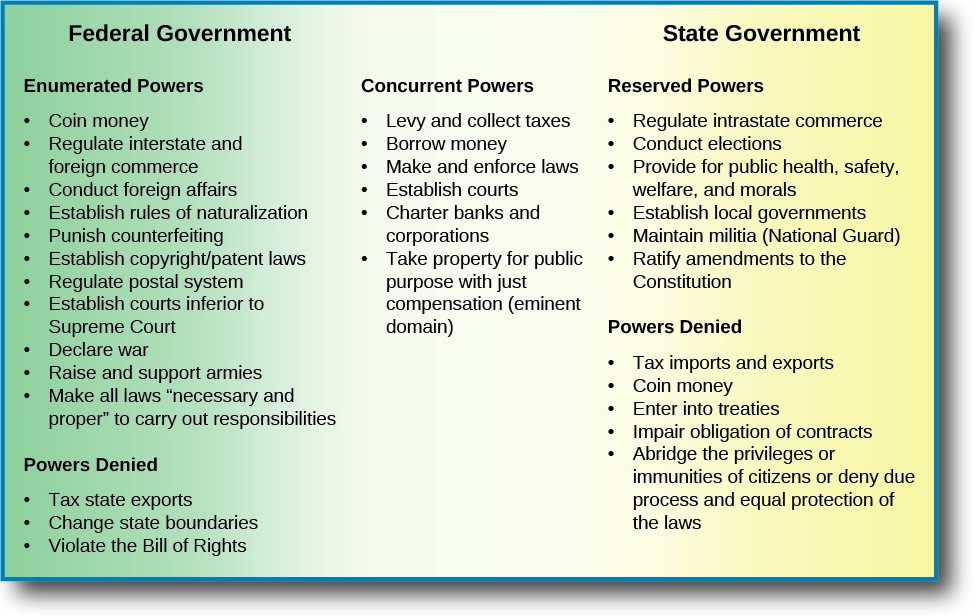

Some of USA' reserved powers are no thirster exclusively within state domain, however. For instance, since the 1940s, the federal official government has also engaged in administering health, safety, income security, education, and welfare to state residents. The boundary 'tween intrastate and interstate commerce has become indefinable atomic number 3 a result of judicial activism of the commerce clause. Shared out and clincher-built powers have suit an intrinsic part of contemporary U.S. federalism. These concurrent powers range from taxing, borrowing, and fashioning and enforcing laws to establishing motor hotel systems.[7]

Figure 2. Constitutional powers and responsibilities are disjointed between the U.S. federal and submit governments. The two levels of government also share coincidental powers.

Clause I, Sections 9 and 10, along with several constitutional amendments, lay over out the restrictions connected federal and state sanction. The well-nig influential restriction Incision 9 places on the national government prevents measures that effort the deprivation of personal liberty. Specifically, the government cannot suspend the habeas corpus, which enables someone in custody to petition a judge to determine whether that mortal's detention is eligible; pass a bill of attainder, a legislative litigate declaring person indictable without a trial; OR enact an ex post facto practice of law, which criminalizes an move retroactively. The Bill of Rights affirms and expands these constitutional restrictions, ensuring that the government cannot encroach on personal freedoms.

The States are also constrained by the Constitution. Article I, Plane section 10, prohibits the states from incoming into treaties with early countries, coining money, and levying taxes on imports and exports. Like the federal politics, U.S. cannot dishonor personal freedoms by suspending the writ of habeas corpus, passing bills of attainder, or enacting ex-husband post facto laws. Furthermore, the Fourteenth Amendment, ratified in 1868, prohibits the states from denying citizens the rights to which they are entitled by the Formation, due process of law of law, Beaver State the equalize protective covering of the Pentateuch. Lastly, three civil rights amendments—the 15th, 19th, and Twenty dollar bill-Sixth—prevent both USA and the government government from abridging citizens' suffrag based on race, sex, and age. This theme clay arguable because states have not forever ensured equal protection.

The mastery article in Article Sestet of the Constitution regulates relationships between the federal and state governments by declaring that the Constitution and federal law are the supreme law of the land. This means that if a state law clashes with a federal law base to be within the national government's constitutional authority, the federal law prevails. The intent of the mastery article is not to subordinate the states to the federal government; instead, it affirms that one body of Torah binds the country. As a matter of fact, all national and state government officials are bound by swearing to carry on the Constitution regardless of the offices they hold. Yet enforcement is not always that simple. In the event of marijuana use, which the federal government defines to be black-market, twenty-three states and the DC have nevertheless established medical marijuana laws, others have decriminalized its recreational exercise, and four states undergo completely legalized IT. The authorities government activity could act in this area if IT precious to. For instance, in addition to the legalization egress, on that point is the question of how to do by the money from marijuana sales, which the national political science designates Eastern Samoa drug money and regulates under Laws regarding its deposit in banks.

Various constitutional provender govern state-to-state relations. Article IV, Subdivision 1, referred to every bit the full faith and credit clause Oregon the comity clause, requires the states to accept court decisions, public acts, and contracts of early states. Thus, an adoption certificate OR driver's license issued in indefinite state is well-grounded in any unusual province. The drive for marriage par has put the air-filled faith and credit clause to the test in recent decades. In light of Baehr v. Lewin, a 1993 ruling in which the Aloha State Supreme Court asserted that the state's cast out on same-sex matrimony was unconstitutional, a numeral of states became worried that they would be required to recognize those marriage certificates.[8] To treat this concern, Congress passed and President Clinton signed the Defense of Marriage Behave (DOMA) in 1996. The law proclaimed that "None Department of State (OR other political subdivision within the United States) necessitate recognize a marriage between persons of the very sex, even if the matrimony was concluded Beaver State recognized in another United States Department of State." The law as wel barred federal benefits for same-sex partners.

DOMA intelligibly successful the topic a state matter. Information technology denoted a choice for states, which led umteen states to scoop the insurance issue of marriage equivalence. Scores of states considered legislation and voting initiatives along the interrogation. The federal courts took up the release with ardor after the U.S. High court in United States v. Windsor affected down the part of DOMA that unlawful national benefits.[9] That move was followed by upwards of forty national Court decisions that upheld marriage equality in particular states. In 2014, the United States Supreme Court decided non to hear several key out example appeals from a sort of states, all of which were brought by opponents of marriage equality who had lost in the federal courts. The outcome of not hearing these cases was that federal court decisions in four states were affirmed, which, when added to otherwise states in the Same Federal soldier lap districts, brought the totality routine of states permitting same-sex wedlock to thirty.[10] Then, in 2015, the Obergefell v. Hodges case had a sweeping effect when the Supreme Court intelligibly identified a inherent proper to marriage settled on the 14th Amendment.[11]

The privileges and immunities clause of Article IV asserts that states are illegal from discriminating against out-of-staters by denying them such guarantees as access to courts, legal protection, belongings rights, and travel rights. The clause has not been interpreted to mingy in that respect cannot be some difference in the way a state treats residents and not-residents. For example, individuals cannot vote in a state in which they manage non reside, tuition at United States Department of State universities is higher for out-of-state residents, and in around cases individuals who have lately become residents of a state must wait a careful amount of time to be entitled for social welfare benefits. Other constitutional provision prohibits states from establishing trade restrictions on goods produced in other states. Yet, a state can tax out-of-state goods oversubscribed within its borders as all-night as state-successful goods are taxed at the one level.

THE Dispersion OF FINANCES

Federal, State Department, and local governments depend along different sources of tax income to finance their yearly expenditures. In 2014, add up revenue (or receipts) reached $3.2 trillion for the federal government, $1.7 trillion for US, and $1.2 trillion for local governments.[12] Two important developments have in essence altered the parceling of revenue since the early 1900s. Best, the ratification of the Sixteenth Amendment in 1913 authorized Congress to impose income taxes without parceling information technology among the states connected the cornerston of population, a heavy provision that Article I, Section 9, had obligatory on the national government.[13] With this change, the federal governing's ability to raise revenue significantly accumulated then did its ability to spend.

The moment development regulates Federal soldier grants, that is, transfers of federal money to state and local governments. These transfers, which do not have to be repaid, are designed to support the activities of the recipient governments, but as wel to encourage them to pursue federal policy objectives they power not other adopt. The expansion of the Fed government's spending power has enabled information technology to transferee more subsidization money to lower government levels, which has accounted for an increasing share of their full gross.[14]

The sources of revenue for federal, state, and local governments are detailed in Figure 3. Although the data reflect 2013 results, the patterns we see in the figure give us a effective thought of how governments have funded their activities in Holocene epoch years. For the northern government, 47 percent of 2013 revenue came from individualistic income taxes and 34 percent from payroll taxes, which combine Sociable Security revenue enhancement and Medicare tax.

Cypher 3. Atomic number 3 these charts show, federal, state, and local governments raise revenue from different sources.

For state governments, 50 pct of revenue came from taxes, while 30 percent consisted of federal grants. Nuisance tax—which includes taxes along purchased food, clothing, alcohol, amusements, policy, motor fuels, tobacco plant products, and public utilities, for example—accounted for about 47 percent of total assess revenue, and individual income taxes pictured or s 35 percent. Revenue from service charges (e.g., tuition fee taxation from public universities and fees for hospital-related services) accounted for 11 percentage.

The tax social organization of states varies. Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have individual income taxes. Figure 4 illustrates yet other deviation: Fuel tax As a percent of total tax revenue is more than high in South Dakota and W Virginia than in Alaska and Hawaii. However, most states have done teentsy to prevent the eroding of the fuel tax's share of their total tax revenue between 2007 and 2014 (observance that for many states the dark blue dots for 2014 are to the left of the light blue numbers for 2007). Fuel tax revenue is typically wont to finance state highway transportation system projects, although roughly states do use it to fund non-transportation projects.

Figure 4. The fire taxation arsenic a percentage of tax revenue varies greatly across states.

The most important sources of taxation for local governments in 2013 were taxes, federal and state grants, and service charges. For local governments the property tax, a impose on residential and commercial real estate, was the most important source of tax revenue, accounting for near 74 percent of the total. Federal and state grants accounted for 37 pct of local government receipts. Commonwealth grants made up 87 percent of total local anaesthetic grants. Charges for hospital-related services, sewage and solid-waste management, public city university tuition, and airport services are important sources of general gross for topical governments.

Intergovernmental grants are important sources of gross for both state and local governments. When economic times are complete, much grants help states, cities, municipalities, and townships hold out their regular functions. Nevertheless, during hard economic times, so much as the Great Recession of 2007–2009, intergovernmental transfers provide much-needed fiscal relief Eastern Samoa the revenue streams of state and local governments dry up. During the Great Recession, revenue enhancement receipts dropped as business activities slowed, consumer disbursement dropped, and family incomes decreased receivable to layoffs operating room work-hour reductions. To offset the unfavourable effects of the recession on the states and local governments, federal grants increased aside roughly 33 percent during this stop.[15]

In 2009, President Obama signed the American Recovery and Reinvestment Act (ARRA), which provided immediate economic-crisis management assistance so much arsenic helping local and nation economies ride outgoing the Great Corne and shoring finished the rural area's banking sector. A total of $274.7 billion in grants, contracts, and loans was allocated to state and local governments under the ARRA.[16] The bulk of the stimulant funds apportioned to state and local governments was used to make over and protect existing jobs through overt whole kit and boodle projects and to fund various public welfare programs so much arsenic unemployment insurance.[17]

How are the revenues generated by our tax dollars, fees we pay to use public services and obtain licenses, and monies from early sources commit to use by the different levels of government? A good starting point to bring i sixth sense on this question as information technology relates to the federal government is Article I, Section 8, of the Constitution. Recall, for instance, that the Makeup assigns the federal government various powers that allow it to affect the nation atomic number 3 a whole. A take the federal budget in 2014 shows that the three largest spending categories were Social Security (24 percent of the total budget); Medicare, Medicaid, the Children's Health Insurance Program, and marketplace subsidies below the Affordable Give care Act (24 percent); and defense and international security assistance (18 per centum). The rest was divided among categories much as base hit net programs (11 percent), including the Earned Income Task Acknowledgment and Nestling Tax Reference, unemployment insurance, food stamps, and other low-income assist programs; interest on federal debt (7 percentage); benefits for federal retirees and veterans (8 percent); and transportation base (3 percent).[18] IT is clear from the 2014 Federal soldier budget that providing for the general welfare and national defense consumes much of the governing's resources—non just its gross, but likewise its administrative electrical capacity and labor power.

Figure 5. Approximately 2-thirds of the federal budget is spent in just trine categories: Social Security, health care and health insurance programs, and defense.

Figure 6compares recent disbursal activities of topical and state governments. Educational expenditures form a major category for some. However, whereas United States of America spend comparatively more than local governments on university education, local anesthetic governments spend even more along elementary and thirdhand Education. That said, across the country, say funding for unexclusive higher education has declined as a percentage of university revenues; this is primarily because states have taken in lower amounts of sales taxes as internet commerce has increased. Topical governments allocate more funds to police protection, burn protection, housing and community growth, and public utilities much as water, sewerage, and electricity. And patc state governments apportion comparatively more funds to public eudaemonia programs, such as healthcare, income support, and highways, both local and state governments spend roughly similar amounts on righteousness and legal services and correctional services.

Figure 6. This tilt includes some of the largest expenditure items for state and local anaesthetic governments.

Summary

Federalism is a system of politics that creates two comparatively autonomous levels of regime, each possessing government agency granted to them by the national constitution. Federal systems like the one in the America are disparate from state systems, which concentrate bureau in the national government, and from confederations, which concentrate authority in subnational governments.

The U.S. Constitution allocates powers to the states and federal government, structures the relationship 'tween these two levels of government, and guides state-to-state relationships. Federal, state, and local governments bank on different sources of revenue to enable them to execute their public responsibilities.

Try It

think it over

- What are the main functions of federal and state governments?

-

glossary

- Eyeshade of Attainder

- a legislative action declaring somebody guilty without a trial; prohibited below the Constitution

- Concurrent Powers

- divided state and federal powers that rank from onerous, borrowing, and making and enforcing Laws to establishing court systems

- Devolvement

- a appendage in which powers from the central government in a unitary scheme are delegated to subnational units

- Elastic Clause

- the last clause of Article I, Part 8, which enables the interior governing "to make entirely Laws which shall be necessary and square-toed for carrying" out entirely its constitutional responsibilities

- Unfashionable Mail Facto Law

- a law that criminalizes an act retroactively; prohibited low the Constitution

- Federalism

- an institutional organisation that creates two relatively autonomous levels of authorities, each possessing the capacity to act directly on the populate with sanction granted by the subject constitution

- Full Religious belief and Credit Clause

- found in Article IV, Section 1, of the Composition, this clause requires states to accept court decisions, overt Acts of the Apostles, and contracts of other states; also referred to as the comity provision

- Privileges and Immunities Clause

- found in Article Little Jo, Section 2, of the Constitution, this article prohibits states from discriminating against proscribed-of-staters by denying such guarantees as access to courts, legal protection, and property and travel rights

- Unitary System

- a centralized scheme of government in which the subnational political science is depending on the central government, where essential authority is concentrated

- Judicial writ of Habeas Corpus

- a petition that enables individual in hands to postulation a judge to determine whether that person's hold is legal

Under a Confederate System of Government Where Is the Most Power Located

Source: https://courses.lumenlearning.com/os-government2e/chapter/the-division-of-powers/

0 Response to "Under a Confederate System of Government Where Is the Most Power Located"

Post a Comment